FIRSTSUN CAPITAL BANCORP (FSUN)·Q4 2025 Earnings Summary

FirstSun Beats on Revenue, Stock Jumps 2.4% After Hours as NIM Expands to 4.18%

January 26, 2026 · by Fintool AI Agent

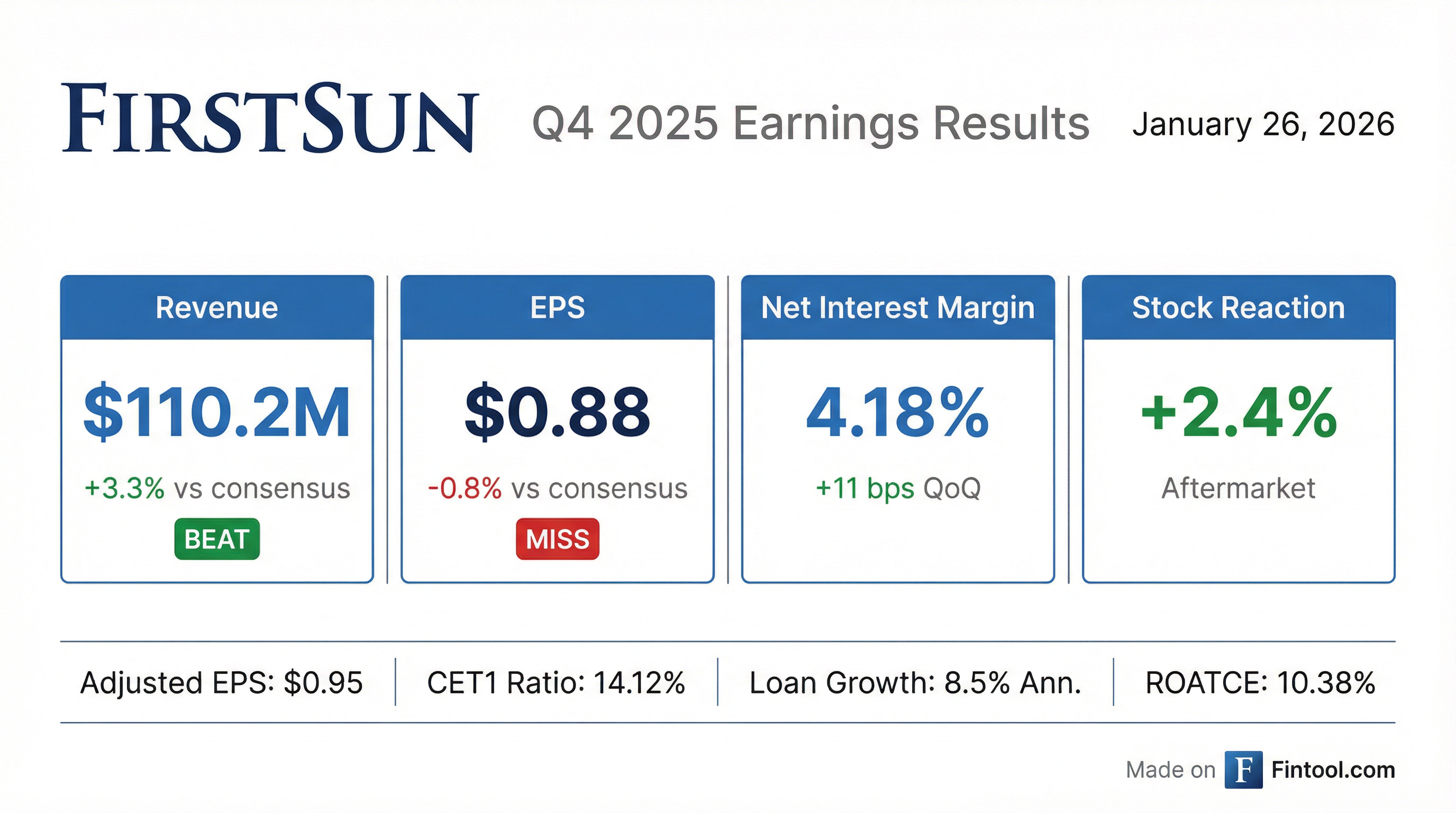

FirstSun Capital Bancorp (NASDAQ: FSUN) delivered a mixed quarter with revenue beating consensus by 3.3% while reported EPS came in slightly below expectations. The $8.5 billion regional bank posted solid net interest margin expansion and maintained strong capital ratios as it advances toward closing its First Foundation merger. The stock jumped 2.4% in after-hours trading to $38.70.

Did FirstSun Beat Earnings?

Revenue: Beat. Total revenue of $110.2 million exceeded consensus of $106.7 million by 3.3%, driven by a 3.1% sequential increase in net interest income to $83.5 million.

EPS: Slight Miss. Reported diluted EPS of $0.88 came in marginally below consensus of $0.89 (-0.8%). However, adjusted EPS of $0.95 (excluding $2.2 million in merger-related expenses) beat expectations by 7.3%.

The beat was driven by:

- NIM expansion: Net interest margin rose 11 bps to 4.18%, the 13th consecutive quarter above 4.00%

- Funding cost improvement: Cost of funds declined 22 bps as deposit repricing outpaced asset yield compression

- Fee income strength: Noninterest income of $26.7 million (24.3% of revenue) supported by loan syndication and swap fees

How Did the Stock React?

FSUN shares rose 2.4% in after-hours trading to $38.70 following the earnings release. The stock had declined 4.8% on January 23rd, potentially reflecting pre-earnings positioning or broader market weakness.

Year-to-date performance: FSUN trades at $37.81, up 13% from its 52-week low of $29.95 but down 17% from its 52-week high of $45.32.

Valuation snapshot:

- Price/Tangible Book Value: 0.99x (at $37.64)

- Price/LTM Adjusted EPS: 10.60x

What Changed From Last Quarter?

The key delta: Funding cost improvement drove NIM expansion despite declining asset yields. Average interest-bearing deposit costs fell 21 bps to 2.60% as the bank shifted mix toward lower-cost money market accounts and away from higher-cost CDs. End-of-December deposit spot rate was ~190 bps (vs. 198 bps Q4 average). Money market promo rate stands at 3.45% for top-tier consumer balances.

Credit quality improved: Nonperforming loans declined to 0.91% from 1.04%, and classified loans trended down 5% sequentially. Net charge-offs normalized to 0.30% (annualized) from 0.55% in Q3.

What Did Management Guide?

Management provided comprehensive 2026 standalone guidance (excluding First Foundation merger impact):

Key assumptions: Two Fed rate cuts by year-end, stable NIM, and no material changes to current macroeconomic environment. Guidance explicitly excludes any impact from the pending First Foundation merger.

Key Management Quotes

"We are very pleased with our strong operating results in the fourth quarter. Among the highlights were our growth in net interest margin to a strong 4.18%, average loan growth of 8.5%, annualized and revenue growth driving our earnings growth."

— Neal Arnold, CEO

"We are also encouraged with the progress we are making with the First Foundation team on operational integration planning and balance sheet optimization work."

— Neal Arnold, CEO

"Given all the M&A activity in Texas, we have seen more opportunity than we originally thought to pick up solid bankers with good relationships. Houston's been a priority. We continue to add in Dallas."

— Neal Arnold, CEO

"We look forward to running our retail strategy play in Southern Cal in their branches. I think there's great opportunity...there's a robust treasury management opportunity on that multifamily portfolio, not just property counts, but actual deposit relationships."

— Neal Arnold, CEO

Q&A Highlights

Deposit betas going forward? (Woody Lay, KBW): Management expects betas to track "lighter" than historically due to competitive deposit pricing. CFO Cafera noted: "We do expect it to be less than the 40%+ betas that we've been able to enjoy historically." The end-of-December deposit spot rate was ~190 bps vs. 198 bps average for Q4, suggesting continued momentum.

What drove special mention increases? (Woody Lay, KBW): Primarily interest rate pressure on borrowers persisting from elevated rates, not pervasive credit issues in any sector. Management noted "no pervasive themes" — the increase was "lumpy" and driven primarily by one particular name. As rates stay lower, management expects pressure to abate.

Loan pricing and credit spreads? (Matt Olney, Stephens): Credit spreads "have been holding pretty well" across the franchise footprint with no material changes in trends. Minor variations exist market-to-market, but the core C&I lending spreads remain stable.

NIM trajectory standalone? (Michael Rose, Raymond James): NIM expected to remain "relatively stable" in 2026 vs. 2025. Deposit competition will be tougher, but asset-side flexibility from variable-rate loans provides room to engage competitively. Two Fed rate cuts are baked into guidance.

Texas vs. California hiring opportunity? (Michael Rose): More opportunity in Texas than originally expected due to heavy M&A activity creating talent availability. Southern Cal buildout is largely complete with "minor holes" to fill. Texas hiring will be opportunistic, particularly in Houston and Dallas.

Pro forma guidance update? (Matthew Clark, Piper Sandler): No updates to pro forma projections at this time. Management remains "extremely excited" about post-merger prospects. "There's always some pluses, minuses. But all in all, yeah, we continue to remain extremely excited."

First Foundation Merger Update

FirstSun's pending acquisition of First Foundation Inc. continues to progress:

- Definitive joint proxy statement/prospectus filed with SEC January 15, 2026

- Proxy materials mailed to shareholders January 16, 2026

- Integration planning on track across all workstreams

- Balance sheet repositioning — loan downsizing and hedging activities progressing "right on schedule"

CEO Arnold addressed First Foundation's liability structure: "First Foundation's balance sheet is a term asset, short-funded kind of structure. We're certainly taking action to reduce some of that. Both with hedging and with the activity that we're working on together, I think we feel good about the progress we've made."

Post-close, the combined company will have a loan-to-deposit ratio in the mid-80s range (vs. FSUN standalone at 93.9%), providing more flexibility on deposit pricing and potentially supporting NIM expansion.

The merger would significantly expand FirstSun's footprint in California and create a combined entity with greater scale across the Southwest and Western U.S. markets.

What's the Balance Sheet Story?

Capital strength: CET1 at 14.12% provides significant buffer above the 8% well-capitalized threshold, positioning FirstSun for organic growth and the First Foundation integration.

Deposit quality: 63% of deposits are FDIC-insured, with commercial business deposits representing 45% of total deposits and 75% of noninterest-bearing deposits. Uninsured and uncollateralized deposits are 29% of total.

Full Year 2025 Highlights

FY 2025 represented a strong year of execution with operating leverage driving 29% EPS growth despite challenging rate environment.

Risks and Concerns

Merger execution risk: The First Foundation integration requires regulatory approvals and successful balance sheet repositioning. Management noted "diversion of attention" as a risk factor.

Credit normalization: While improved sequentially, net charge-offs of 43 bps for FY 2025 were elevated versus the 5-year average of 19 bps, primarily from two C&I relationships: a telecom credit (which took an additional charge in Q4 after partial charge-offs in prior quarters) and a cross-border credit. These two loans represented ~75% of FY 2025 charge-off dollars. Management expects FY 2026 NCOs in the mid-to-high 20s bps.

Rate sensitivity: ~65% of the loan portfolio is variable rate, with ~40% repricing monthly. Continued Fed cuts would pressure asset yields faster than funding costs can adjust.

CRE exposure: While regulatory CRE to capital is a manageable 113%, office CRE exposure of 4% of loans bears monitoring given market headwinds.

The Bottom Line

FirstSun delivered a solid quarter with revenue beating expectations on NIM expansion and fee income strength. The slight EPS miss on a reported basis is overshadowed by adjusted results that exceeded consensus. With the First Foundation merger progressing and 2026 guidance calling for continued growth, the 2.4% after-hours pop reflects market confidence in the combined franchise potential.

Key debates for investors:

- Can NIM stability persist if the Fed cuts more aggressively than the two cuts assumed in guidance?

- Will First Foundation integration costs weigh on near-term earnings?

- Does the 10.6x adjusted P/E adequately reflect merger synergy potential?

View full Q4 2025 8-K filing | Earnings call transcript | FirstSun company page